How does reverse-charging VAT work?

Find out how shifting VAT works between two EU member states.

When two companies within the European Union do business with each other, the rule is that VAT must be shifted from supplier to customer. If you pay Eventix service costs outside the Netherlands but within the EU, this also applies to you. This article explains how reverse-charging works, why it is done, and what this means for your bookkeeping.

Goods and services that are supplied from one EU country to another are called 'intra-Community supplies'. VAT is thereby transferred from the supplier to the customer.

How does reverse-charging VAT work?

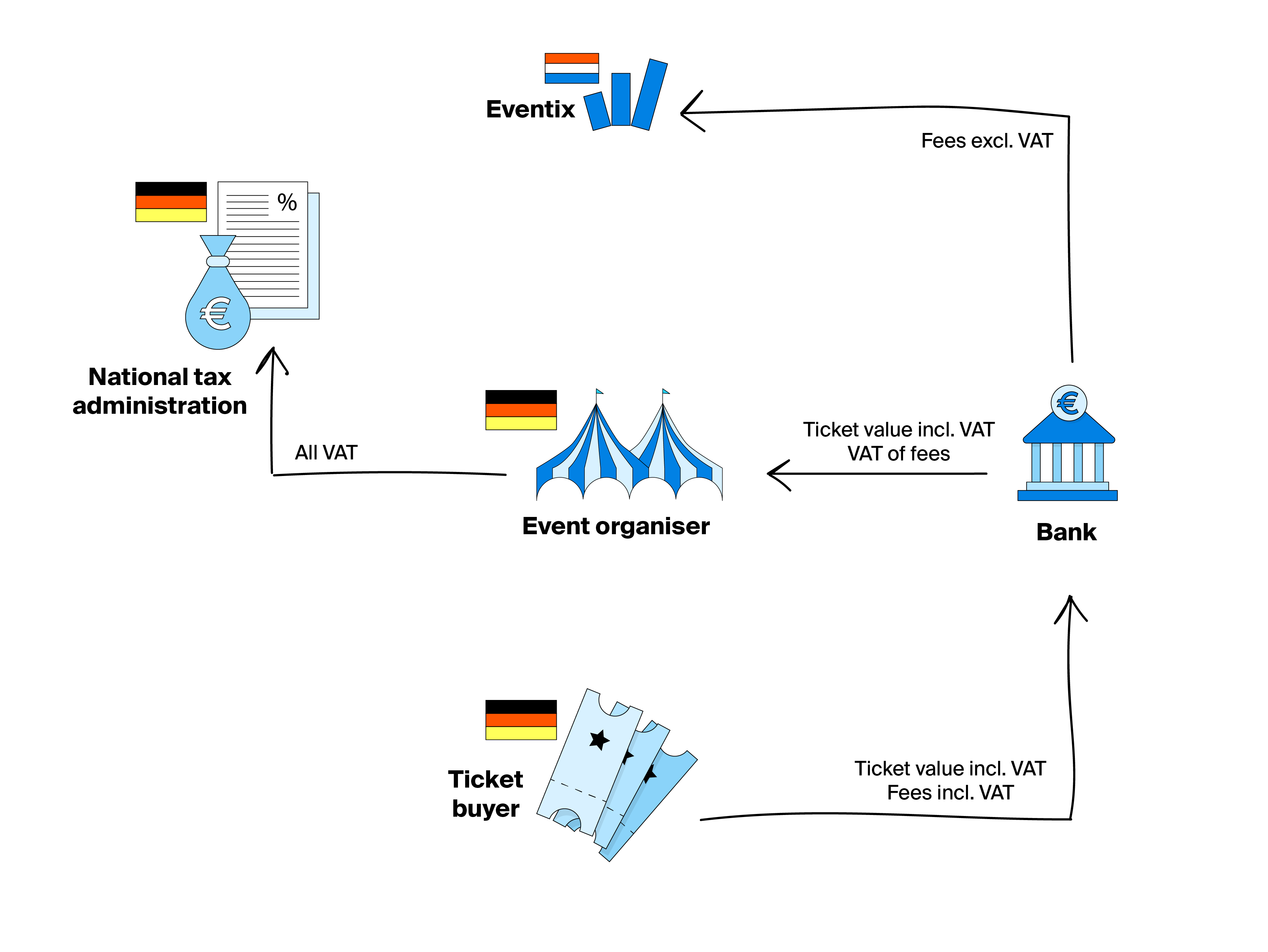

When the Eventix (based in the Netherlands) service fees are invoiced to organisers in EU countries other than the Netherlands, the VAT is reverse-charged and the service is taxed in the country of the organiser. Because of the reverse-charge mechanism, the VAT is shifted from the supplier (Eventix) to the customer (the organiser). In this case, Eventix does not charge VAT on the invoice but shifts the VAT to the organiser who purchases Eventix’ service. The organiser pays the VAT in his own country, and it is reclaimed in the same return. On balance, no VAT is paid.

Below we’ve put together an example of how Eventix and an organiser from another EU country can correctly reverse their VAT:

The Dutch company Eventix provides its ticket service to event organisers throughout the EU. Eventix is hired for the German event "Party Ohne Ende", organised by the event organisation POE.

On the invoice for these tickets, Eventix puts 'reverse-charge VAT'. Eventix includes its VAT identification number and that of its customer on the invoice. On the invoice, Eventix also mentions that it is an intra-Community supply (a service within the EU).

Eventix must report the reverse-charge of VAT in its VAT declaration. In the VAT declaration, Eventix fills in the number of sales to POE under section 3b (in the Netherlands); supplies to or services in countries within the EU. Since Eventix has carried out an intra-Community supply, the supply is also processed in a declaration of intra-Community supplies (ICP).

When submitting its tax return, POE must also report the reverse-charge and VAT payable in Germany based on the intra-Community supply.

How do I make sure the VAT is reverse-charged correctly?

Eventix is based in the EU in the Netherlands. The costs for the service will be invoiced from the Netherlands. Do you organise events from another country within the European Union? Then the VAT on the service and transaction costs will automatically be shifted (Provided that all (invoice) requirements for reverse-charging VAT are met. Otherwise, Dutch VAT will be charged on the service fees). You can specify your country of residence in the company settings of the Dashboard. You must also enter your VAT number, as we will need this to reverse the VAT.

A practical example

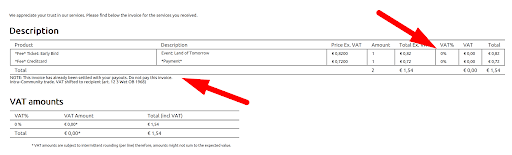

If you indicate that you’re located in a country other than the Netherlands within the EU in your settings, you’ll see that no VAT is applied to the Eventix invoice. Below is an example invoice of a customer who pays € 0.82 excl. VAT per ticket to Eventix.